Bar Code Imaging: Trends in the Americas

(Thanks to VDC Research Group Analyst Richa Gupta for today's article.)

(Thanks to VDC Research Group Analyst Richa Gupta for today's article.)

With our highly granular supply- and demand-side research coverage, VDC considers it important to help vendors answer some key questions as they look to achieve their business profitability objectives.

Where is growth coming from? What is driving it? Where does the opportunity lie? What can suppliers do to cash in?

One of the most significant trends we have been tracking with our coverage of the bar code scanner market is the ongoing (and impending) migration from laser scanners to imaging technology. Today we're focusing on the region that is expected to continue accounting for a significant portion of the overall handheld scanner revenues and share – the Americas.

The 2011 market for handheld scanners in the Americas played out differently across the North and South – with enterprises in the US and Canada actively migrating from laser scanners and investing in camera-based imaging solutions, and those in Central and Latin America focusing their barcode technology investments on linear imagers or CCD scanners. This speaks volumes about the approach being taken by organizations within each of these regions and their respective country markets.

The more mature markets are putting significant dollars toward upgrading their technology deployments in order to extend the value offered by their data capture platforms. Emerging country markets, on the other hand, are investing in low price solutions to meet the demand arising from compliance-driven applications.

2D Imagers are to North America what Linear Imagers are to Latin America

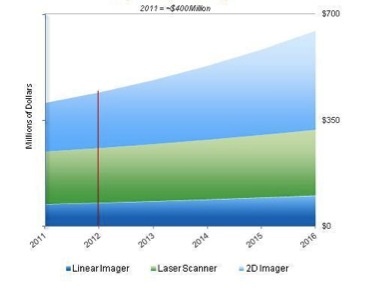

According to VDC’s forecasts for the handheld scanner space, the overall Americas market is set to grow at a CAGR (Compounded Annual Growth Rate) of over 9% to about $650 million by 2016, with expectations of significantly higher 2D imager sales to North American enterprises.

We expect to see (continued) heavy investments in camera-based imaging solutions within the US and Canada – the market for 2D imagers here is slated to grow at a CAGR of over 15% from 2011-2016, which is 6 points higher than the aggregate growth for handheld scanners in the overall region. This explosive growth for 2D imagers is being driven by:

- Need to future-proof technology investments;

- Ability to layer on multiple applications on 2D imager platform (beyond traditional track-and-trace);

- Need to decode more information present on barcodes today;

- Effectively combat competitive decisions and pressures; and

- Higher spending propensity in North America versus less established markets.

Americas Handheld Scanners Demand Segmented by Product Type

Figure 1: Americas Handheld Scanner Demand

Enterprises within the developing economies in Central and Latin America continue to make investments in linear imagers, with the relatively low cost of these solutions being a major adoption driver. VDC forecasts a CAGR of about 13% from 2011-2016 in the region for linear imagers, far outpacing that of laser scanners.

Installation environments within manufacturing and transportation & logistics verticals account for well over half of all investments in handheld barcode scanners in the region, as organizations strive to maintain compliance with industry and government regulations for track-and-trace, anti-counterfeiting and brand protection. VDC’s research indicates that some of the key adoption drivers for linear imagers within these environments include:

- Attractive entry-level price points;

- Offer aggressive scan rates for users wishing to decode linear and/or stacked linear symbologies;

- Wide array of feature and functionality support by these general purpose bar code scanners; and

- No moving parts to misalign or break, unlike laser scanners.

Figure 2: Country-level CAGR for Handheld Scanner Market

(Images courtesy of VDC Research Group)

How Vendors Can Capture Their Share of Handheld Bar Code Imaging Growth

Some of the significant trends and key opportunity areas that VDC has identified in the Americas are described below:

Target and capitalize on opportunities in the SMB market – VDC’s end user research shows that although the small-and-medium business (SMB) market lacks the deployment size and scale of larger organizations within the Americas, we have identified (and validated) tremendous revenue-generating opportunities in this segment, giving rise to:

- A larger number of vendors and their channel partners competing to cash in on the growth potential being offered;

- Escalated development of low-cost, high performance solutions that meet the automation needs of this enterprise community; and

- Increased user demand to directly deploy the “latest and greatest” (i.e., imaging solutions) as these enterprises start from scratch.

Act as a trusted advisor in terms of helping enterprises achieve customer service excellence – Although VDC sees continued investments in handheld scanning solutions to maintain compliance with regulatory standards in industries including food & beverage, pharmaceuticals and automotive, increased consideration and attention is being given to unique user requirements that can be satisfied through support for imaging technology. For example, vendors can enable enterprises to elevate their customer-facing service levels by supporting auto forms fill, scanning barcodes/symbologies displayed on cell phone screens and personalizing the overall customer experience in both traditional (i.e., retail) and non-traditional (i.e., hospitality) scanning environments.

Cultivate Symbiotic Relationships – VDC expects vendors to invest in building strategic alliances and partnerships with the Independent Software Vendor (ISV) community – leveraging these players’ domain expertise such as vertical market specialization in order to offer highly customized and application-specific feature and functionality sets to their end user customers. It is also becoming increasingly important for hardware vendors to prepare their partners to support the broader suite of handheld scanning technologies in order to adequately fulfill user/application requirements.

Last words on the state of bar code imaging technology

As we highlight all of these opportunities for vendors competing in the space to shatter current and future growth targets in the Americas, there is one looming threat that no one should ignore – that posed by consumer handhelds.

Mobility has been a raging theme across customer-facing application environments, particularly in North America, for 12-18 months now. Scanner vendors should keep tabs on incremental improvements to technology, functionality and device usage as they continue pursuing emerging business opportunities.

Continued economic volatility could also drastically impact these growth predictions and market development opportunities within verticals, industries, regions and/or country markets. VDC considers it important for vendors to keep an eye out for potential disruptions to end users’ handheld scanner investment plans and have the flexibility to tweak their product portfolio and pricing strategies to meet market needs and requirements.

The goal, as always, is to empower enterprises with the right handheld scanning technology for the right application at the right price.

While trying to capitalize on the growth potential offered by the handheld scanner market across vertical markets and use environments (especially within the high-growth imager product categories), suppliers need to place emphasis on re-inventing, innovating and developing solutions that are high performance, reasonably priced and have the ability to support multiple functionalities – to ensure business sustainability and continued monetary success.

VDC continues to explore barcoding technology adoption, penetration and migration trends in our ongoing research program – Strategic Insights 2012: Barcode Solutions Market. You can gain access to complimentary research on the market here.

About the Author

Richa is VDC’s lead barcode analyst in the firm’s AutoID research practice. She is responsible for VDC’s syndicated and custom consulting coverage of the markets for barcode scanning and printing solutions. She has also worked on the firm’s research around customer engagement technologies.

About VDC Research Group

VDC Research Group (VDC) provides exceptionally detailed direct-contact market research and consulting services to many of the world's largest technology suppliers, innovative start-ups and leading investors. The firm is organized around six practices, each with its own focused area of coverage. Our clients rely on us for highly segmented research and analysis which is derived from our unwavering commitment to the idea that all markets are collections of smaller market segments and that winning companies must develop and execute strategies that are segment- specific. Please visit our website at www.vdcresearch.com to learn more.

See related articles:

Bar Code Hardware Resource - Bar Code Scanners and Bar Code Readers

Bar Code Industry Predictions, Part 2

2D Imagers: Useful Today, Essential Tomorrow

{jcomments on}