ScanSource: POS and AIDC Industry Continues to Grow

An Interview with Jeff Yelton, President ScanSource POS and Barcoding, NA.

An Interview with Jeff Yelton, President ScanSource POS and Barcoding, NA.

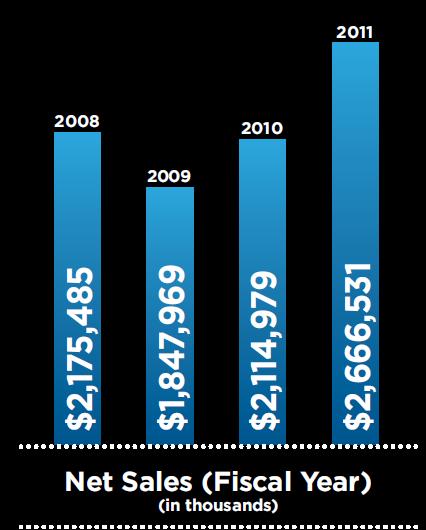

This week we were able to get a chance to talk with Jeff Yelton, President of ScanSource POS and Barcoding, North America. In our discussion we spoke about 1D and 2D bar code scanners, RFID, POS, mobility. ScanSource had a record year in their FY2011, which ended June 30, 2011. ScanSource sales hit a new high, up 26% to $2.7 billion. Earnings also set a record and this is encouraging for the industry, particularly in the face of a flat global economy.

Where was this growth coming from? Was it sustainable? Or was it just a backlog of a need to replace equipment that had been ignored in the recent economic downturn of the last few years? Are there new trends shaping up to drive demand in different market niches? Here’s what we learned.

First, according to Yelton, retailers are continuing to invest in new equipment to drive productivity to new levels. He said that he’d had concerns in 2010 about whether the resurgence of sales growth was going to continue, but what they’ve found is that growth is strong -- it’s being driven by structural changes in the organizations utilizing the technology. Many companies, having cut back on staff, are now achieving productivity gains through the use of more technology!!

RFID

One example is in the use of RFID, which is showing solid gains in sales as an emerging technology. The growth in this area, which many had expected to be driven by a mandate from Wal-Mart and other major retailers, is in fact being supported by the high ROI generated by the adoption of RFID. Apparel is one category where RFID tags are being attached to merchandise. And a basic benefit is the ability for a retail clerk to scan a department and instantly identify what sizes/styles/colors need to be restocked on the show room floor. RFID has not yet made its way to the checkout register, but many companies are installing RFID in the supply chain, and the expectation is that it will gradually migrate to the point of sale – although RFID is apparently not about to eliminate the POS register.

NFC, Tablets and Mobility

Two major trends affecting the industry are, according to Yelton, NFC (Near Field Communications) and secondly, tablets, like the Apple iPad. Some models of phones are now carrying the necessary NFC technology and this is expected to increase smartly over the next few years. New equipment will have to be added to the checkout lane to accommodate NFC.

A key question that VARs and vendors seem to be asking is if the preferred item of installation is going to be the consumer version of the iPad tablet or iPhone (Lowes Stores just bought 42,000 iPhones for their stores), or if a “ruggedized” or commercial version is going to emerge or be required. Are the iPhone and iPad cheap enough and durable enough to be a disposable and replaceable POS item, or will a sturdier version be required? A bigger threat to the traditional POS cash register may be mobile devices, which Yelton said may impact the lane (checkout lane), within three years, but it was still too early to tell. There is increasing interest by retailers in mobile checkout technology not just for line busting at holiday time, but for general customer satisfaction. Indeed, more and more consumer apps let a customer check himself out and have merchandise delivered without interacting with a sales person! Any shopper at an Apple store will delightedly tell you how he was checked out by the Apple staff with an iPhone instantly. No waiting on line. That trend is clearly just beginning to take root.

Digital Signage – Non-interactive vs. Interactive

Just how hot is digital signage? Yelton broke out digital signage into two separate segments for us. Non-interactive vs. Interactive – the former has become more of a commodity he said, with lower margins. That equipment is used on end-caps, tracking displays and the like. The Interactive segment is still emerging and it seems like VAR (value added reseller) opportunities are strong here. Most of these are wired to the Internet, and the integration of real-time store data makes the device capable of delivering high quality information to the consumer. Due to the fact that it is not a solution in a box, and interaction with the store data requires software engineering, this is likely to remain a product for Tier 1 and Tier 2 vendors at the present time. ScanSource carries digital signage products.

2d Imaging scanners vs. traditional 1D scanning

Are 1d barcode scanners doomed we asked? Not yet, but the trend is clearly toward 2D imaging scanners. Even though the 2D scanners are priced in the area of 2.5 to 3.5 times higher than the 1D scanners, major companies are moving to them with the expectation of taking advantage of the 2D capabilities over time. The growth rate of 2D scanner sales is now running in the 20% to 40% range; we need to point out however, that the numbers in the initial years were low to begin with. Still, ScanSource expects this niche to continue to show strong demand.

In summary, things are looking good in the POS and Barcoding markets. Vendors are reporting solid expectations for the fourth (current) quarter of 2011.

Bar code and Point of Sale Industry members should be enthused about the prospects for 2012!

ScanSource Inc. is the world’s largest distributor of Point of Sale (POS) and Auto Identification (AIDC) equipment. More information can be obtained on the company website www.scansource.com

Note to readers: This article is based on an interview with Jeff Yelton, conducted October 19, 2011 and information taken from the ScanSource Annual Report.

ScanSource, Inc. (NASDAQ: SCSC) operates as a wholesale distributor of specialty technology products, providing distribution sales and services to resellers in the specialty technology markets, including automatic identification and data capture (AIDC) and point-of-sale (POS) solutions through its ScanSource POS & Barcoding sales unit; voice, video and converged communications equipment through its Catalyst Telecom and ScanSource Communications sales units; and physical security solutions through its ScanSource Security sales unit.

ScanSource, Inc. was founded in 1992 and is headquartered in Greenville, South Carolina

Related articles:

Speed, Functionality and Expanded Usage Push 2D Imaging Scanners Ahead of Laser Scanners

Barcode & Point of Sale Reseller Event Hosted by ScanSource

Barcode and POS Industry Luminaries Shine Light on 2011

ScanSource Keeping It Green With EV Charging Station

YouTube Video's that illustrate how to make labels and bar codes:

QR Code with a URL Web address

Create a QR Code for business cards

Make sheets of bar code labels

{jcomments on}